India’s warehousing market delivered robust growth in the first half of 2025, reflecting the country’s economic resilience despite global challenges, according to the Knight Frank’s report authored by Yashwin Bangera, Director – Research. The market saw a significant increase in transaction volumes, rising by 42% year-on-year to 32.1 million square feet. This growth was not dependent on a single sector, indicating a more resilient and diverse occupier base. Such expansion in warehousing space also signals growing requirements for professional cleaning and facility management services to maintain operational efficiency and hygiene standards across modern facilities.

Modern warehouses are increasingly adopting smart technologies such as automated cleaning systems, IoT-enabled environmental monitoring and robotic material handling. For example, Amazon’s fulfilment centres are almost fully automated, with robotic systems handling storage, retrieval and packaging. Such automation reduces manual labour but increases the need for precision cleaning, preventive maintenance and specialised facility management to ensure smooth operations.

Key Market Drivers

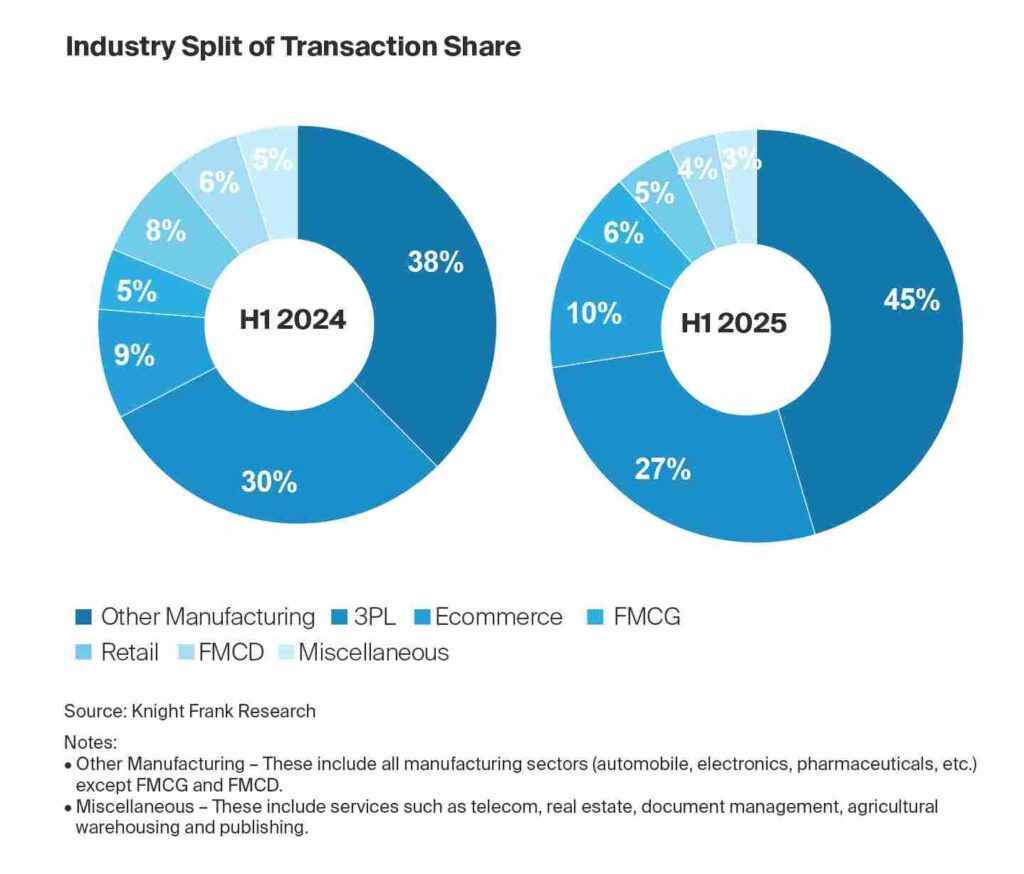

The manufacturing sector emerged as the primary driver of transaction volumes, overtaking the traditional market anchor, the 3PL (Third-Party Logistics) sector. The sector’s transaction activity accounted for 45% of the total volumes, representing a 71% year-on-year growth. The government’s ‘Make in India’ and Production Linked Incentive schemes also boosted the manufacturing sector. This trend is illustrated in the ‘Industry Split of Transaction Share’ graph A.

This expansion in manufacturing-led warehousing activity also increases demand for specialized facility management solutions, from routine cleaning to waste management, ensuring operational continuity in high-volume industrial spaces.

While the manufacturing sector led the way, the 3PL sector also had a healthy performance, accounting for 27% of the total volumes and experiencing a 30% year-on-year growth.

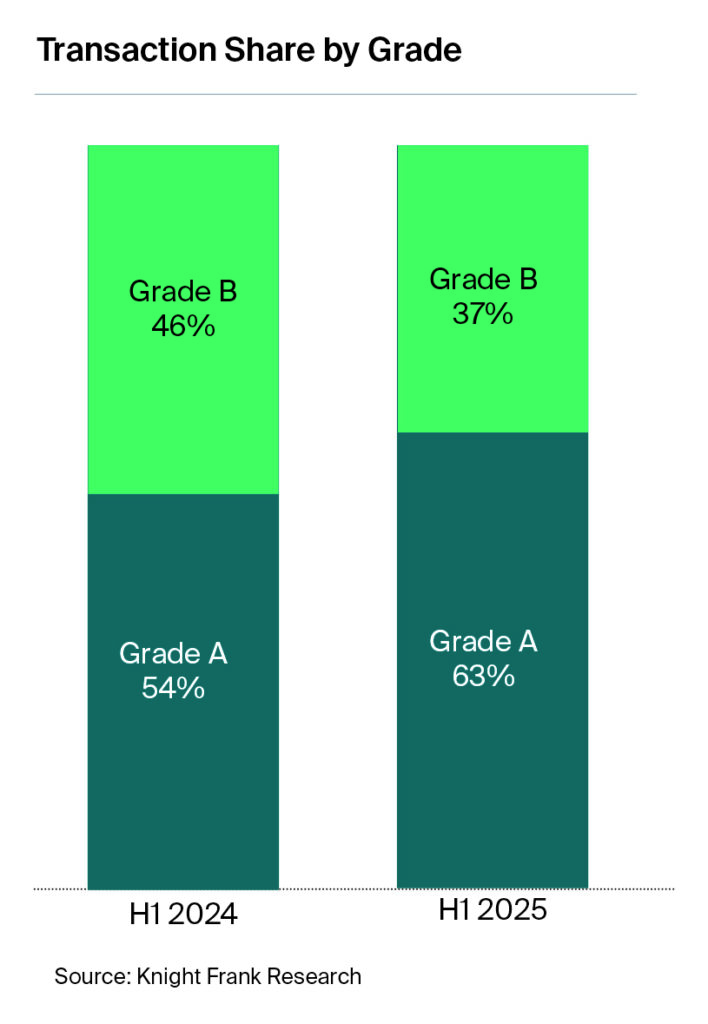

The e-commerce sector showed signs of a strong recovery with a 61% year-on-year increase in volumes, signalling a potential new phase of expansion. The increasing demand from these sectors, especially manufacturing, drove the need for higher-quality Grade A spaces. Grade A spaces made up 63% of the total area transacted, a significant increase from 54% in the first half of 2024.

Many of these facilities are integrating technology-driven solutions such as automated sanitation robots, energy-efficient HVAC systems, AI-driven inventory tracking and smart waste management platforms. Grade A warehouses, with advanced infrastructure and higher standards, particularly require professional cleaning and FM services to maintain hygiene, equipment and compliance standards.

Warehouses following the Amazon model deploy advanced robotics, conveyor systems and AI-driven operations, which heightens the demand for tech-enabled FM services capable of maintaining fully automated environments. This trend is illustrated in the ‘Transaction Share by Grade’ graph B.

City Wise Performance

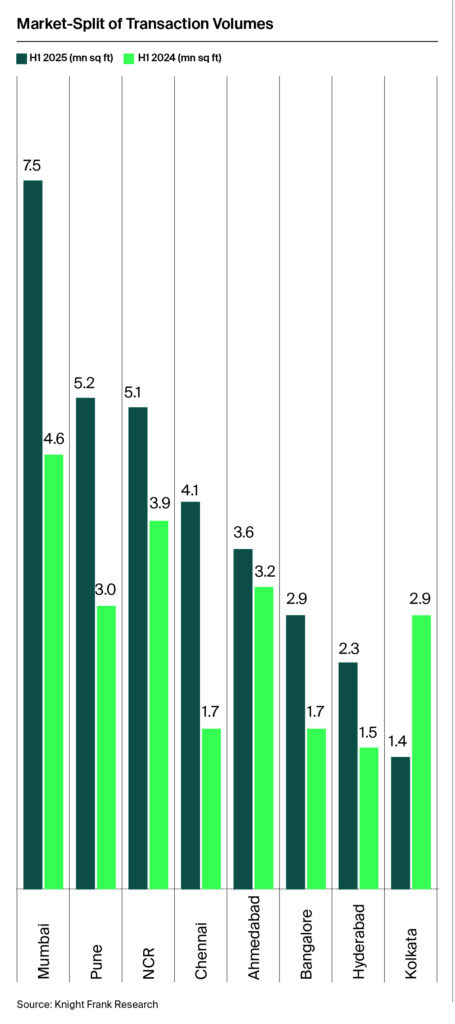

Mumbai led the market, contributing 23% of total transaction volumes with 7.5 million square feet, primarily driven by the 3PL sector, which accounted for 41% of the city’s transacted area. Chennai and Pune also experienced exceptional growth, with transaction volumes increasing by 135% and 76% year-on-year, respectively. The manufacturing sector was the main driver in these cities. Collectively, Mumbai, Chennai and Pune accounted for 79% of the incremental transaction volumes in H1 2025 versus H1 2024.

As these cities lead warehouse expansion, local FM providers are likely to see increased demand for structured cleaning schedules, preventive maintenance and specialized services tailored for large industrial spaces.

The adoption of technologies such as AI-based cleaning schedules, IoT sensors for monitoring hygiene and equipment status and automated inventory tracking systems will be critical for managing these large-scale operations efficiently. This is detailed in the ‘Market-Split of Transaction Volumes’ graph C.

Rent and Vacancy

Rent levels remained stable across all markets, with growth ranging between 3% and 5%, driven by strong occupier demand, particularly from the manufacturing sector and a shortfall in new supply.

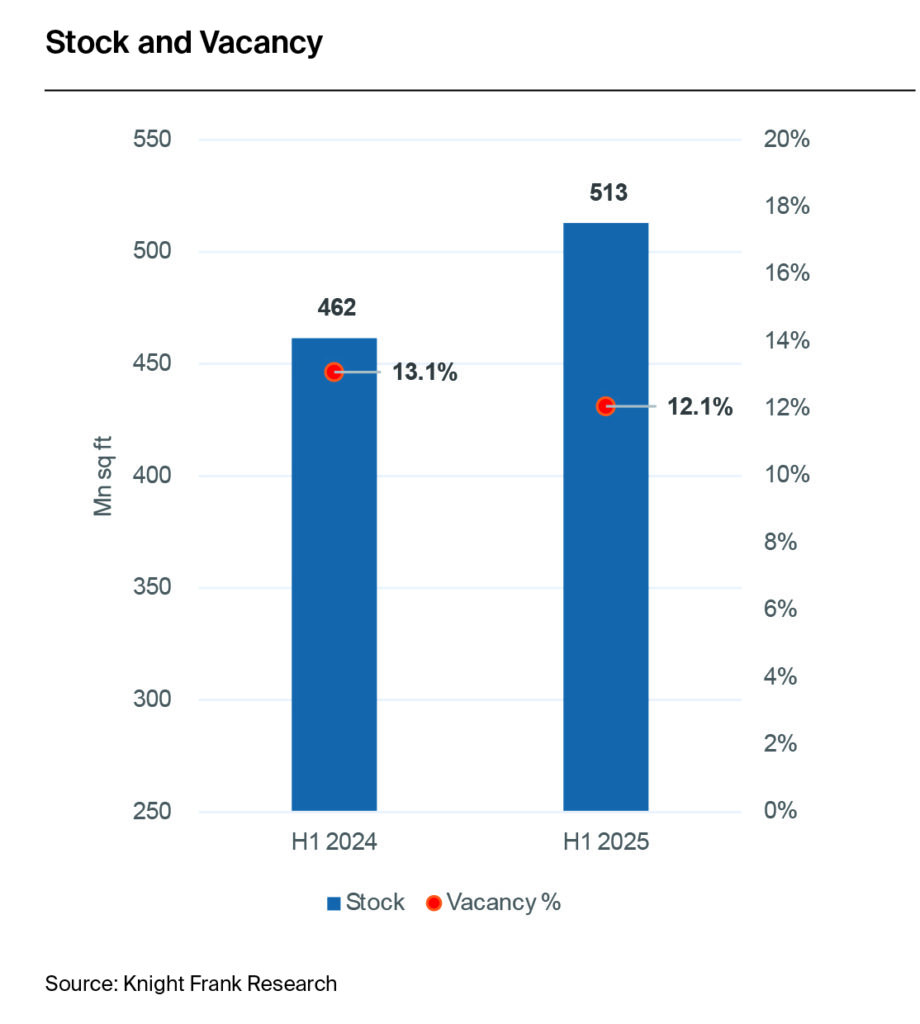

India’s warehousing and industrial market reached a total stock of 513 million square feet across the top eight markets in the first half of 2025. Despite 26.9 million square feet of new space becoming operational, supply remained insufficient to meet high demand, resulting in a decline in overall vacancy rates from 13.1% in H1 2024 to 12.1% in H1 2025.

Lower vacancy rates imply higher occupancy and operational activity, which in turn drives consistent demand for cleaning and FM services to ensure warehouses remain functional, safe and compliant with quality standards. This data is presented in the ‘Stock and Vacancy’ graph D.

Bright Ahead

According to the report, the Indian warehousing market is poised for continued growth in the second half of 2025. The 42% year-on-year rise in transaction volumes during H1 underscores the country’s economic strength and stability. Meanwhile, the manufacturing sector is expected to remain a key driver, as companies continue to diversify and de-risk their supply chains away from China.

The government’s support through policies like the Production Linked Incentive scheme also plays a crucial role. Additionally, the e-commerce and 3PL sectors are showing positive signs of recovery and will be important to watch.

For the cleaning and facility management sector, this trend translates into clear growth potential. Expanding warehouse operations, particularly Grade A and highly automated facilities, will require professional hygiene, maintenance and facility management solutions.

In addition to manpower-driven services, warehouses are expected to increasingly implement innovative technologies such as UV-C disinfection systems, predictive maintenance platforms, IoT-based environmental monitoring and robotic cleaning solutions. The example of Amazon demonstrates the future of warehousing, where automation and robotics dominate.

FM providers that can manage cleaning, maintenance and environmental monitoring in such fully automated facilities will be critical partners in sustaining operational excellence.

Overall, despite global disruptions, the market’s strong fundamentals and growing occupier confidence are expected to sustain its positive trajectory for the rest of the year.

Growth of Automation in Warehouse Cleaning

There is a growing trend of warehouse operators adopting automated cleaning technologies. According to reports:

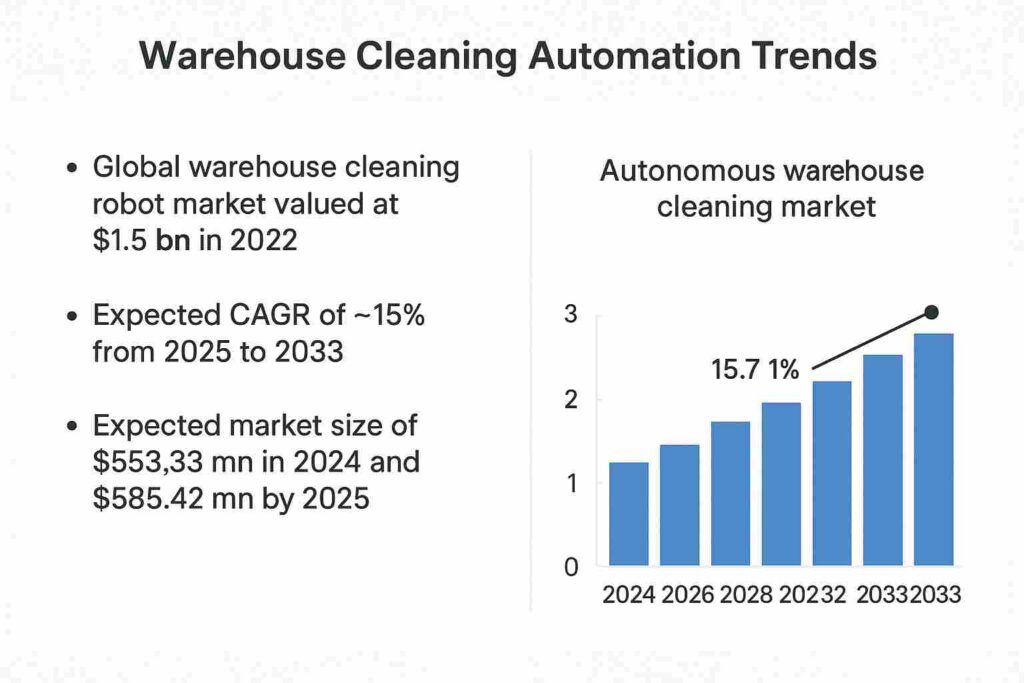

• The global warehouse cleaning robot market was valued at approximately $1.5 billion in 2022, with a projected annual growth rate of around 15% over the next five years.

• In 2024, the warehouse cleaning robot market was valued at $553.33 million and is expected to reach $585.42 million by 2025, indicating a steady upward trajectory.

• The autonomous warehouse cleaning market size reached $1.14 billion in 2024, with a projected compound annual growth rate (CAGR) of 15.7% from 2025 to 2033.

These figures suggest a significant and accelerating adoption of automated cleaning solutions in warehouses, driven by the need for efficiency, cost reduction and enhanced hygiene standards.

CIJConnect Bot-enabled WhatsApp

CIJConnect Bot-enabled WhatsApp